2025 Global Voting Spotlight

Executive summary

BIS’ Global Voting Spotlight is a comprehensive overview of our approach to voting on corporate governance matters and other material risks and opportunities under our Benchmark Policies from July 1, 2024, through June 30, 2025. Our sole focus when conducting our stewardship program under our Benchmark Policies — including our voting activities — is to advance our clients’ long-term financial interests.

2024-25 proxy year highlights

Voting at a company’s shareholder meeting is a basic right of share ownership and a core principle of corporate governance. As a fiduciary, BlackRock is legally required to make proxy voting determinations on behalf of clients who have delegated voting authority to us in a manner that is consistent with their investment objectives.

BIS’ Benchmark Policies, and the vote decisions made consistent with those policies, reflect our reasonable and independent judgment of what is in the long-term financial interests of clients. BIS does not act collectively with other shareholders or organizations in voting shares.

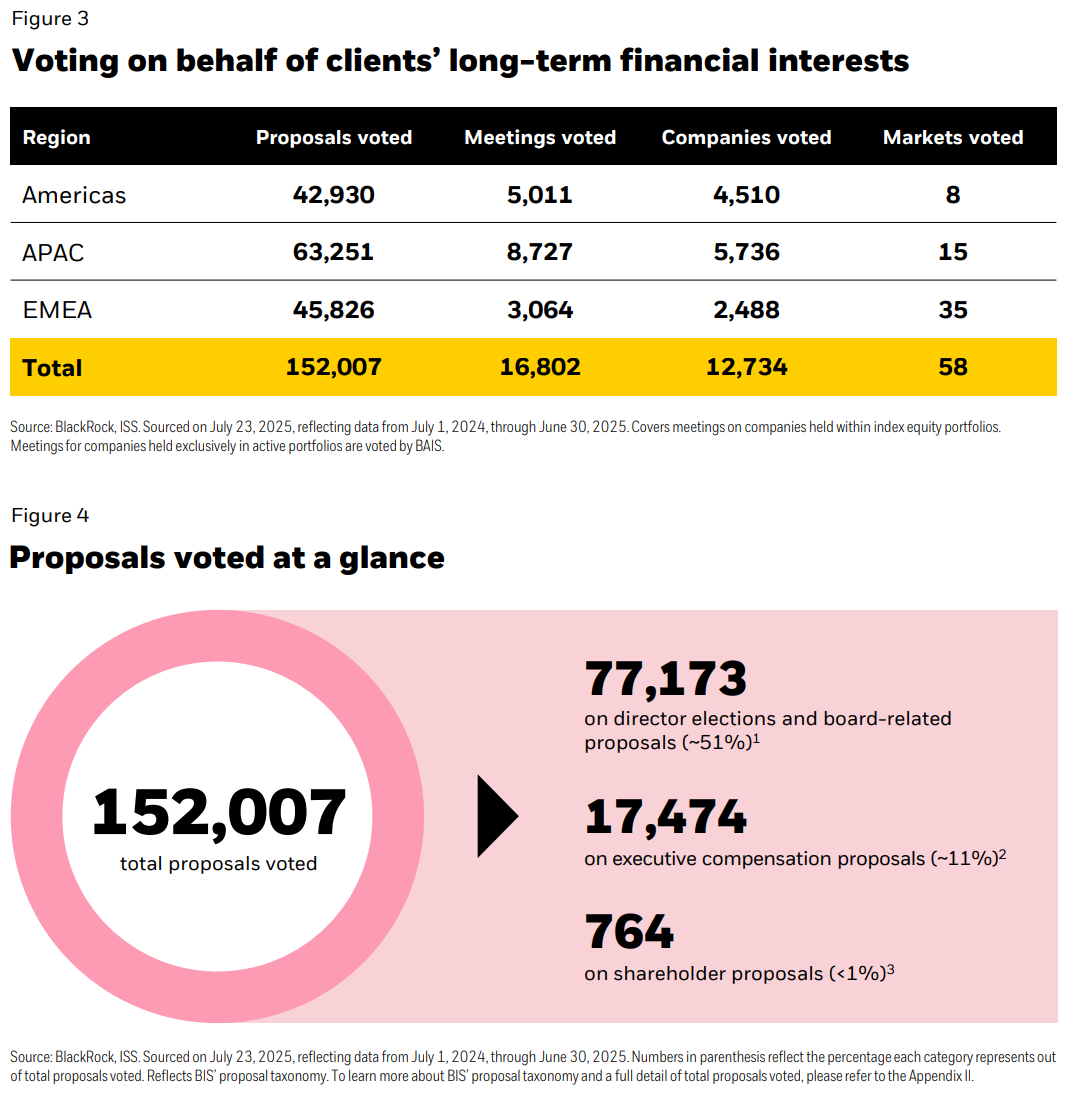

In the 2024-25 proxy year, BIS voted on more than 152,000 management and shareholder proposals globally at more than 12,700 companies in 58 voting markets. The substantial majority of proposals were on ordinary matters such as director elections, board-related items, and auditor ratification.

As in previous years, BIS supported management on ~89% of total proposals voted, reflecting our assessment that boards and management teams generally acted in alignment with shareholders’ interests.

BIS supported ~90% of the more than 70,000 proposals categorized as director elections we voted on globally. Board independence issues remained the primary reason we did not support these proposals globally.

Shareholder proposals continued to represent less than 1% of total proposals BIS voted on during the 2024-25 proxy year. BIS supported ~11% of global shareholder proposals, in line with last year’s support rate.

Consistent with last year, BIS most frequently supported shareholder proposals related to governance matters, particularly those aimed at strengthening minority shareholder rights, such as those requesting the adoption of simple majority voting.

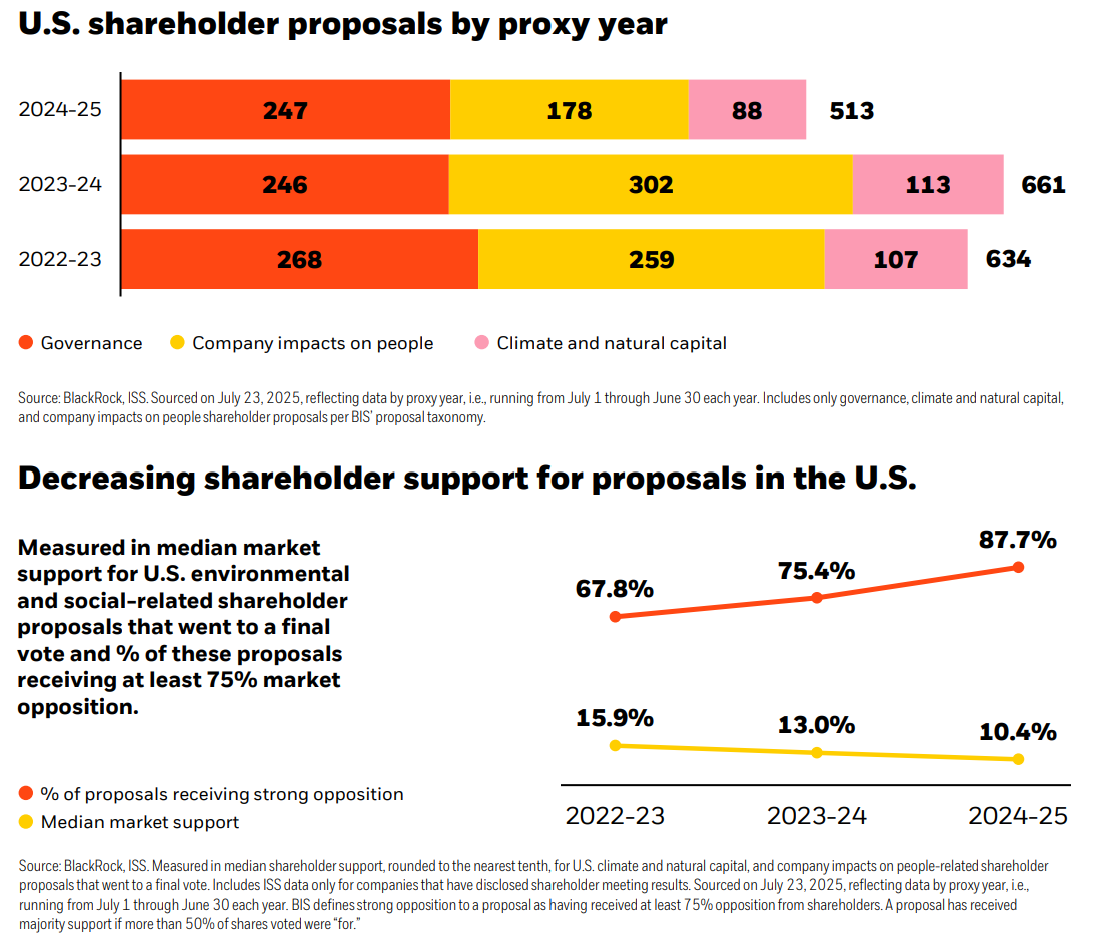

The number of proposals focused on climate and natural capital (environmental) and company impacts on people (social) appearing on company ballots decreased this proxy year, with BIS voting on ~36% fewer of such proposals in the U.S. compared to last year. We again found that many of these proposals were over-reaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term financial value. The majority also addressed business risks that companies already had processes in place to address, making them redundant. As a result, investor support for these proposals — including BlackRock’s — continued to be low.

We continued to expand choice in stewardship. While the majority of clients delegate voting to BIS under our Benchmark Policies, we recognize that our clients’ investment objectives and preferences vary.

BlackRock Voting Choice provides eligible clients with more opportunities to participate in the proxy voting process, where legally and operationally viable. $3.3 trillion of BlackRock’s $6.9 trillion total index equity assets under management (AUM) are eligible to participate in BlackRock Voting Choice, where legally and operationally viable. Clients’ assets representing ~$784 billion in index equity AUM are exercising this option.

By the numbers

Voting in our clients’ long-term financial interests

| Voting at a company’s shareholder meeting is a basic right of share ownership and a core principle of corporate governance. As a fiduciary, BlackRock is legally required to make proxy voting determinations on behalf of clients who have delegated voting authority to us in a manner that is consistent with their investment objectives. BIS does this by casting votes in favor of proposals that, in our assessment, will enhance long-term financial value.

Setting, executing, and overseeing strategy are the responsibility of management and the board. As one of many minority shareholders on behalf of our clients, BlackRock does not direct a company’s strategy or its implementation. BIS does not act collectively with other shareholders or organizations in voting shares and does not follow any proxy research firm’s voting recommendations. BIS does not disclose our vote intentions in advance of shareholder meetings as we do not see it as our role to influence other investors’ proxy voting decisions. In addition, BlackRock does not file shareholder proposals or nominate directors for election to a company’s board. |

BIS’ Benchmark Policies — which are comprised of our Global Principles, regional voting guidelines, and Engagement Priorities — set out the core elements of corporate governance that guide our investment stewardship efforts globally and within each market. The vote decisions made in line with our Benchmark Policies, and on behalf of our clients, reflect our reasonable and independent judgment of what is in the long-term financial interests of clients and are informed by in-depth analysis of company disclosures, comparisons against industry peers, engagement with boards and management teams, and third-party research.

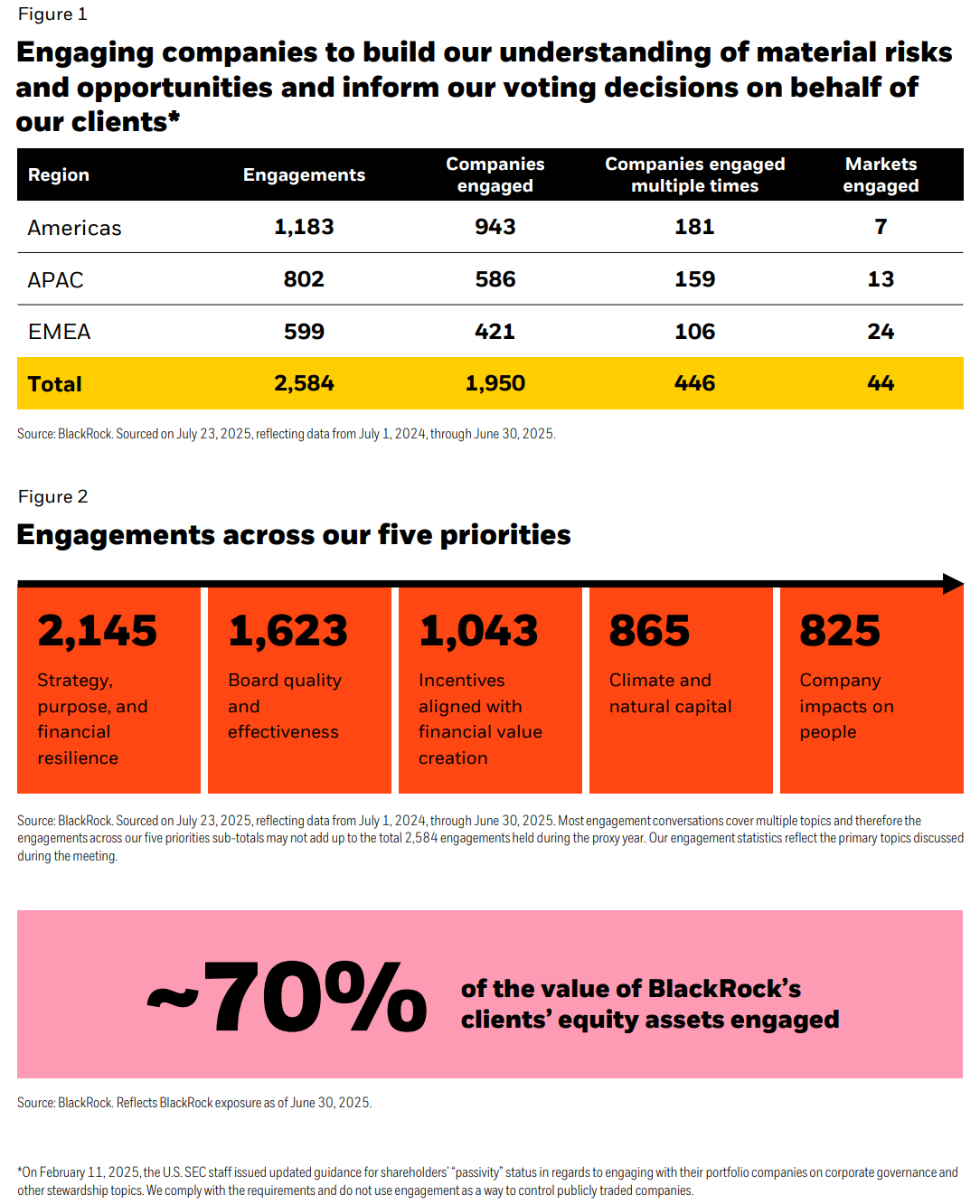

In the 2024-25 proxy year, BIS held 2,500+ engagements with members of the boards and management teams of the companies our clients invest in. Engagements provide companies with the opportunity to share their perspectives on topics that, in BIS’ experience, impact the long-term financial returns BlackRock’s clients depend on to meet their financial goals. In these conversations, BIS listened to company directors and executives to understand how they are overseeing material business risks and opportunities, over time. This helped us make informed voting decisions on behalf of our clients.

During the 2024-25 proxy year, BIS voted at 16,800+ shareholder meetings on more than 152,000 management and shareholder proposals in 58 voting markets. Most of the proposals that we voted on addressed ordinary matters, such as director elections, board-related items, and auditor ratification. Shareholder proposals continued to represent less than 1% of the total proposals BIS voted on globally. As reflected in our voting each proxy year, BIS is generally supportive of management at companies which have sound corporate governance and deliver strong financial returns over time. When we determine it is in our clients’ financial interests to convey concern to companies through voting, we may do so in two forms: we might not support the election of directors or other management proposals, or we might not support management’s voting recommendation on a shareholder proposal. BIS’ stewardship activities during the reporting period are described in the following pages, which include company case studies that illustrate our case-by-case approach to stewardship.

Management proposals

Director elections

Appropriately qualified, engaged directors with characteristics relevant to a company’s business enhance the board’s ability to add long-term financial value and serve as the voice of shareholders in board discussions. In our view, a strong board gives a company a competitive advantage, offering valuable oversight and contributing to the most important management decisions that support long-term financial performance. For this reason, our investment stewardship efforts have always focused on the effectiveness of the board of directors.

The election of directors to the board is a right of shareholders and an important signal of support for, or concern about, the performance of the board in overseeing and advising management.

When casting vote decisions on behalf of clients on the election of directors, we assess a number of factors, including the board’s effectiveness as a group, the relevance of individual directors’ qualifications, time commitments, and skillsets; and how these factors may contribute to the company’s financial performance. We look to boards to establish formal and transparent processes for nominating directors that reflect the company’s long-term strategy and business model.

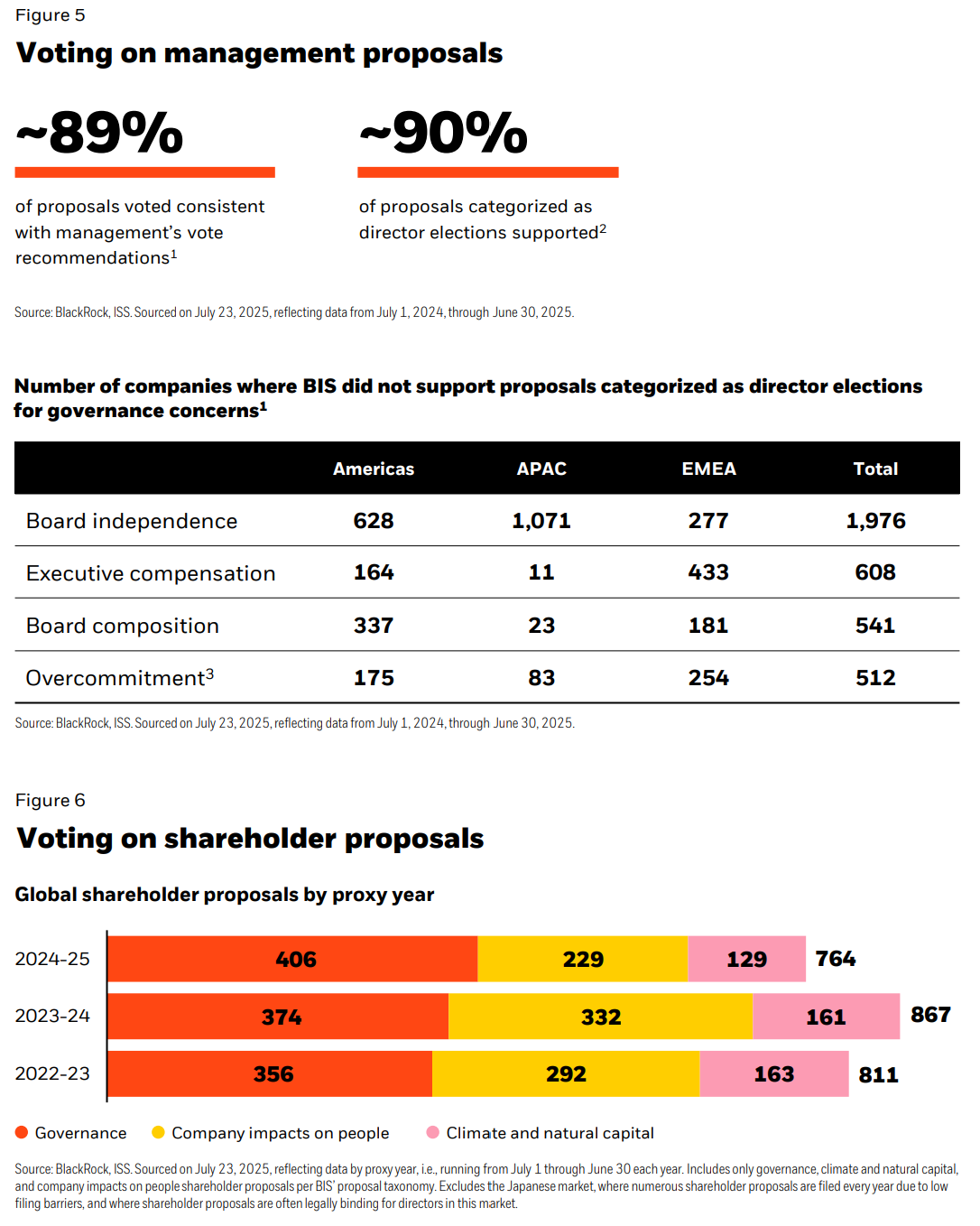

During the 2024-25 proxy year, more than 70,000 of the 152,000+ proposals BIS voted were categorized as director elections. BIS supported ~90% of these proposals, reflecting our assessment that boards and management teams generally acted in alignment with shareholders’ interests. The four key reasons we did not support management recommendations were governance-related and have been consistent over the years: director independence, executive compensation that is not aligned with shareholder interests, board composition, and director overcommitment.

Director independence remained the primary reason we did not support proposals categorized as director elections globally, mainly driven by votes against management’s recommendation in APAC, reflecting the prevalence of controlling shareholder structures in many markets in this region.

During the 2024-25 proxy year, BIS voted to communicate these independence-related concerns on 1,917 proposals categorized as director elections in the APAC market.

Executive compensation

Executive compensation is an important tool used by companies to support long-term financial value creation. In our experience, well-structured compensation policies reward the successful delivery of strategic, operational, and/or financial goals, encourage an appropriate risk appetite, and align the interests of shareholders and executives through equity ownership. We appreciate when companies make clear in their disclosures the connection between compensation policies and outcomes and the financial interests of long-term shareholders.

When assessing compensation proposals, BIS closely reviews companies’ disclosures to determine whether the board’s approach to executive compensation is rigorous and reasonable in light of the company’s stated long-term corporate strategy and specific circumstances, as well as local market and policy developments. When our analysis indicates that executive compensation is misaligned with company performance, we may vote to communicate concerns about the board’s approach. We do so in two forms: we may not support the election of responsible members of the compensation committee, or we may not support other compensation-related management proposals, i.e., “Say on Pay” and grant approvals, which are common practice in markets such as Australia, the U.S., and the UK.

Globally, BIS did not support 1,068 proposals categorized as director elections at 608 companies due to concerns about the alignment of their approach to executive compensation with shareholders’ long-term financial interests during the 2024-25 proxy year. BIS supported ~84% (14,643 out of 17,474) of compensation-related management proposals put to a shareholder vote during the 2024- 25 proxy year. BIS supported ~82% (16,176 out of 19,710) of these proposals during the 2023-24 proxy year. Our support was largely driven by many companies’ clear articulation of how their policies align with shareholders’ long-term financial interests, particularly around how short- and long-term incentive plans complement one another and are effective in rewarding executives who deliver long-term financial value.

Voting on material climate-related risks and opportunities in the 2024-25 proxy year

Many companies are assessing how to navigate the low-carbon transition while delivering long-term financial value to investors. As we have regularly noted in our Benchmark Policies, for companies where these climate-related risks and opportunities are material, we find it helpful when they publicly disclose, consistent with their sector and business model, how they intend to deliver long-term financial performance through the transition to a low-carbon economy.

Recognizing the value of these disclosures, in some jurisdictions, like the UK, large companies must disclose such climate-related financial information on a mandatory basis, while in other jurisdictions these disclosures are viewed as best practice in the market. We do not mandate any specific disclosure framework companies should use; rather, we encourage disclosures that provide investors with insights into how companies are managing the risks associated with climate change by managing their own carbon emissions or emissions intensities to the extent financially practicable. Disclosures consistent with the International Sustainability Standards Board (ISSB) standards or the Task Force on Climate-related Financial Disclosures (TCFD) framework may help investors assess company-specific climate-related risks and opportunities, and inform investment decisions.

We recognize that companies may phase in reporting aligned with the ISSB standards over several years, depending on local requirements. We also recognize that some companies may report using different local standards, which may be required by regulation, or one of a number of voluntary standards. In such cases, we ask that companies disclose their rationale for reporting in line with the specific disclosure framework chosen and highlight the metrics that are industry- or company-specific.

During the 2024-25 proxy year, BIS voted on more than 70,000 proposals categorized as director elections. We voted against 74 of these proposals globally — or 0.1% — at 62 companies because of concerns regarding inadequate disclosure or effective board oversight of climate-related risks. As explained earlier in this report, independence-related concerns were the primary reason we did not support proposals categorized as director elections, globally. In addition, we voted against 40 management proposals for climate reasons at 39 companies in the APAC region — primarily against the approval of board reports.

Over the past several years, BIS has observed continued evolution in company disclosures related to material climate-related risks. These changes reflect both regulatory developments in various jurisdictions and shifting market practices. For example, at the May 2025 AGM of NV Bekaert SA (Bekaert), a Belgian steel manufacturer, BIS supported the election of directors responsible for climate risk oversight following steps the company took to enhance its disclosures during the 2024-25 proxy year. Specifically, Bekaert provided clearer descriptions of how its board and management oversee climate-related risks and opportunities, along with a more comprehensive overview of its approach to sustainability, aligned with the European Sustainability Reporting Standards (ESRS). At the May 2024 AGM, BIS had voted against the election of the longest-tenured director, reflecting the limited visibility at the time into how the company addressed these topics.

Shareholder proposals

In most markets, shareholders have the right to submit proposals to be voted on at a company’s shareholder meeting, as long as certain requirements are met. Shareholder proposals span a wide range of topics and have varying degrees of relevance for companies across sectors, locations, and business models.

BIS takes a case-by-case approach to voting on shareholder proposals and maintains a singular focus on the proposal’s implications for long-term financial value creation for shareholders. Our analysis considers whether a shareholder proposal addresses a material risk that, if left unmanaged, may impact a company’s long-term financial performance. We look for consistency between the specific request formally made in the proposal, the supporting documentation, and the proponents’ other communications on the issues. We take into consideration a company’s governance practices and disclosures against those of their peers. BIS does not support shareholder proposals that we view as inconsistent with long-term financial value or where the intent is to micromanage companies.

BIS observed several themes that shaped voting outcomes on shareholder proposals during the 2024- 25 proxy year:

Higher shareholder support for core corporate governance matters

Governance-related shareholder proposals typically address matters affecting shareholder rights such as proposals to amend governance structures, as well as proposals on executive compensation or capital/share classification structures.

Investors — including BlackRock — supported more governance shareholder proposals than proposals focused on climate and natural capital (environmental) or company impacts on people (social). Median market support for governance-related shareholder proposals globally was ~35%. Many of the proposals BIS supported focused on strengthening the rights of minority shareholders, such as those requesting the adoption of simple majority voting.

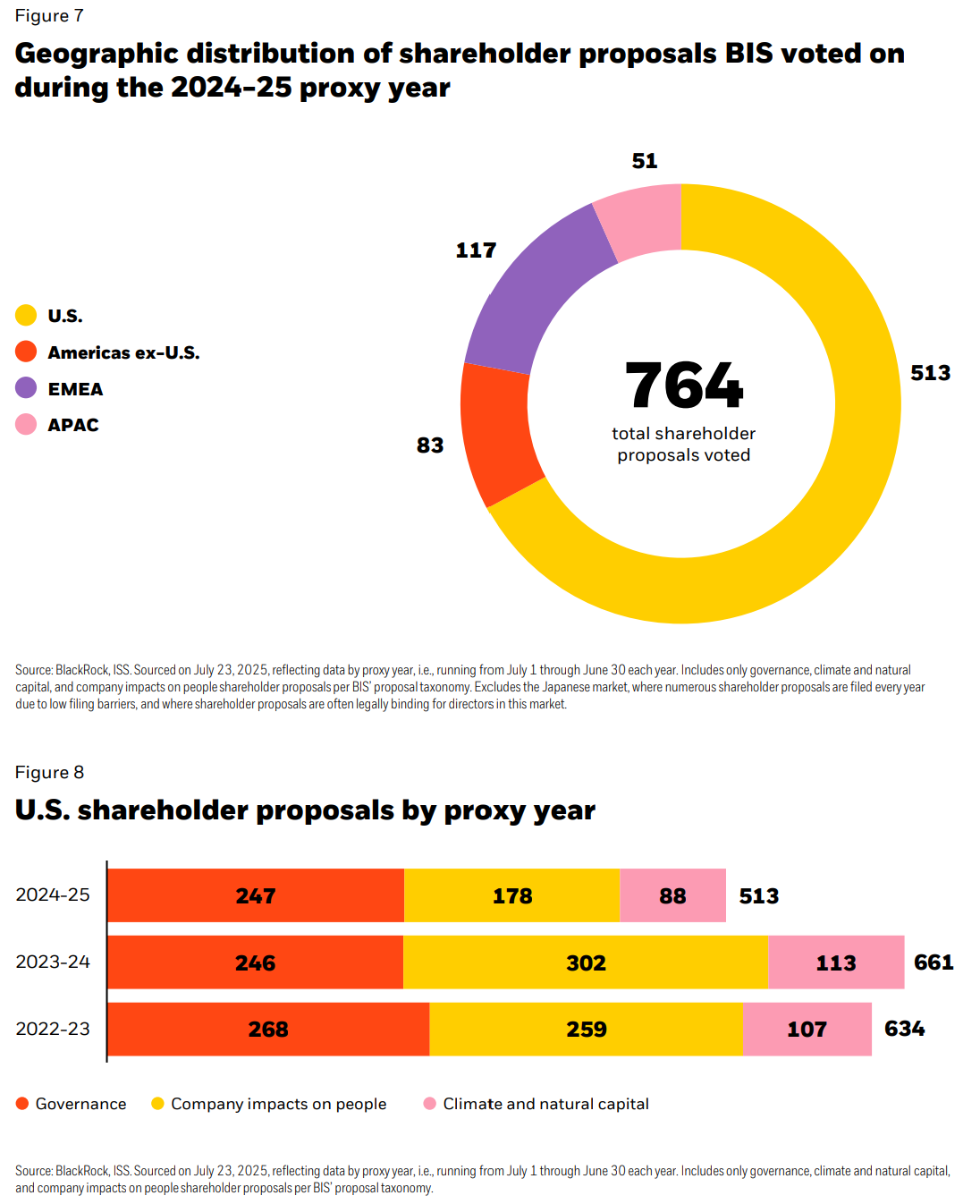

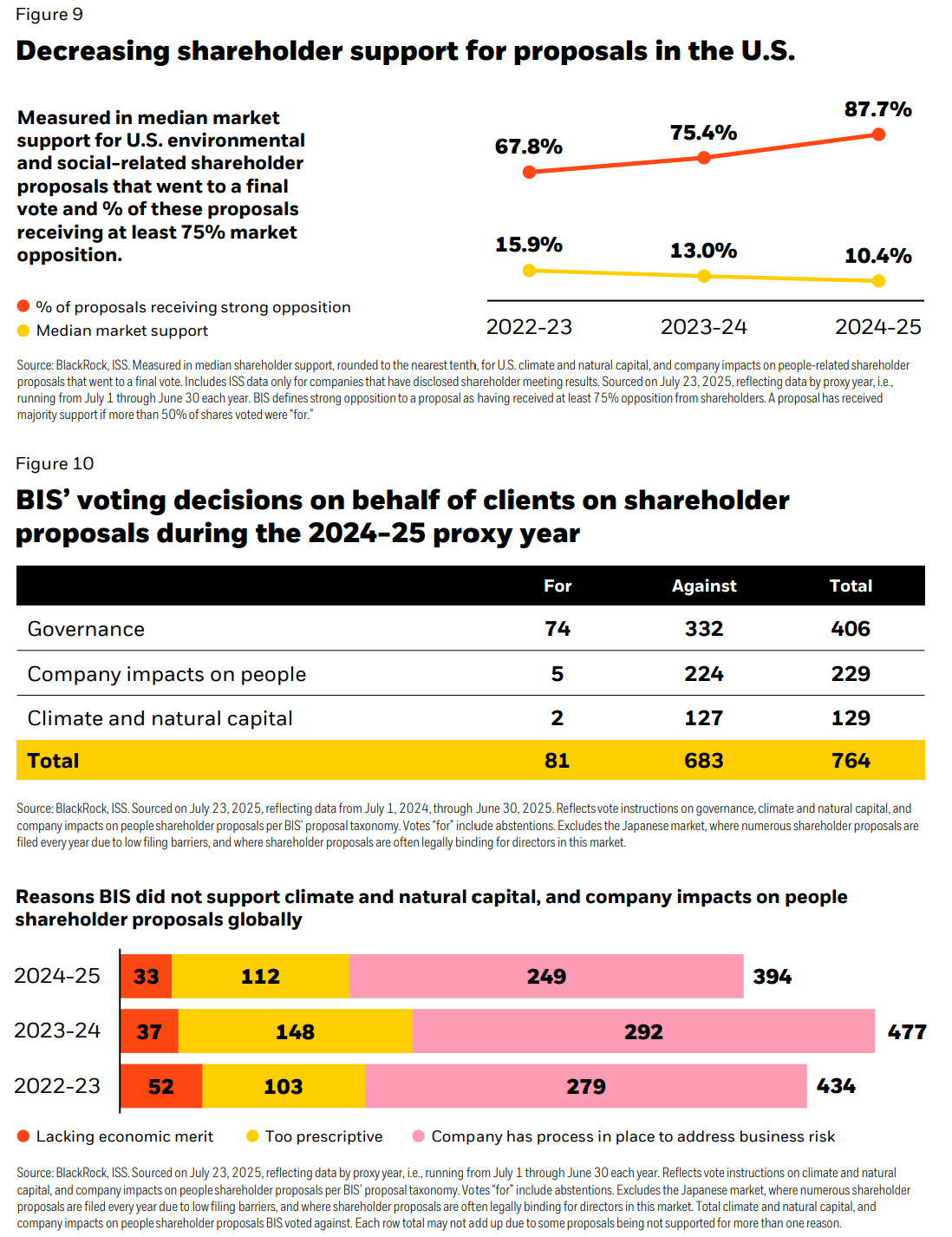

The number of environmental and social proposals filed at U.S. companies declined, and those proposals continued to receive low market support

As in previous years, BIS voted a large volume of shareholder proposals in the U.S. market. While the volume of governance-related proposals remained similar to prior years, following three years of steady growth, the number of proposals focused on climate and natural capital (environmental) and company impacts on people (social) appearing on company ballots decreased this proxy year, with BIS voting on 36% fewer of such proposals in the U.S. compared to last year. This was driven in part by a decrease in proposals filed by advocacy groups.

Another portion of this reduction may be attributed to updated U.S. SEC guidance for reviewing “no action relief” requests. Following this guidance, there was an increase in the number of relief requests made to the SEC. While the SEC granted relief to a similar proportion of company requests compared to last year, the increased number of requests led to an increase in the number of proposals receiving relief. At the same time, the number of proposals voluntarily withdrawn also decreased.

Like last year, environmental and social shareholder proposals in the U.S. market received low market support (median shareholder support of ~10%). Notably, ~88% of the 266 proposals were opposed by more than 75% of the votes shareholders cast.

Shareholder proposals seeking to roll back company efforts to address material sustainability-related risks continue to receive low support

During the 2024-25 proxy year, there continued to be a considerable number of shareholder proposals seeking to roll back company efforts to address material sustainability-related risks. In the U.S., about one in four environmental and social shareholder proposals submitted to a vote sought these actions.

We determined that these proposals were overly prescriptive or lacked economic merit, and we did not support any of the 69 proposals on this matter globally during the 2024-25 proxy year. In our analysis, we considered each company’s policies, practices, and disclosures, as well as the balance between the costs and benefits of addressing the business risk, the merits of the proponent’s request, and long-term financial value creation for BlackRock’s clients. Median market support for these proposals remained low at ~1.2%.

Shareholder proposals focused on corporate political activities declined year over year

Shareholder proposals requesting additional disclosure and/or oversight of corporate political activities are among the most commonly filed. During the 2024-25 proxy year, the volume of proposals related to corporate political activities fell by more than half: BIS voted on 40 of these proposals, compared to 89 in 2023-24.

BIS does not tell companies which policy positions they should take, or how to conduct such activities, including how they should shape their trade association memberships. Instead, we encourage companies to provide investors with disclosures that clarify the governance processes supporting board oversight of these activities, as well as the link between companies’ stated strategic policy priorities and their approach to political activities, including participation in industry associations.

How we voted on shareholder proposals globally

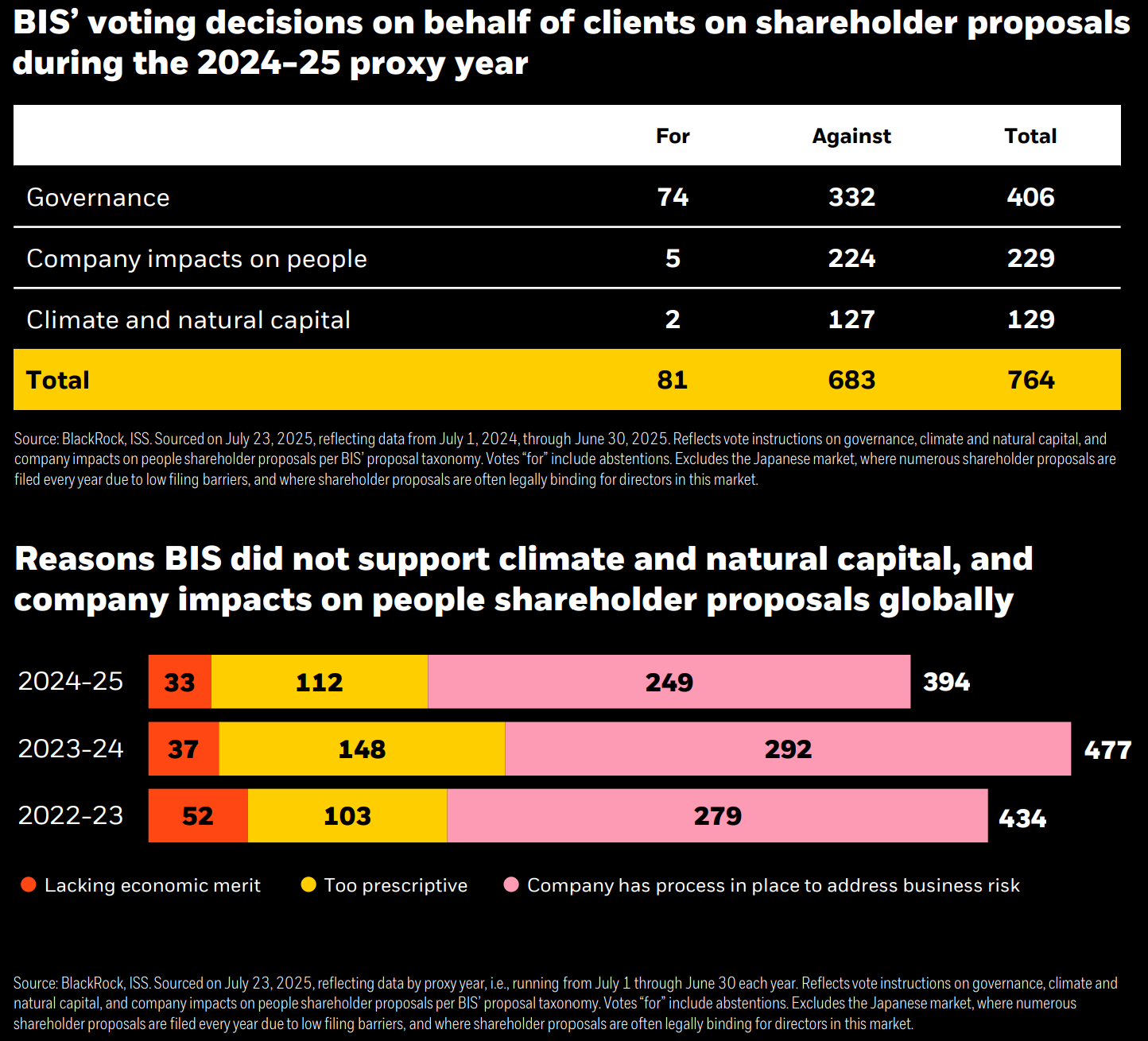

BIS supported ~11% of shareholder proposals in the 2024-25 proxy year (81 out of 764). Consistent with last year, the greatest portion of shareholder proposals BIS supported addressed corporate governance matters, where we supported ~18% (74 out of 406). As mentioned above, many of these proposals we supported focused on strengthening the rights of minority shareholders, such as those requesting the adoption of simple majority voting.

We again found that many shareholder proposals focused on topics related to climate and natural capital, and company impacts on people were overreaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term financial value. The majority also addressed business risks that companies already had processes in place to address, making them redundant. As a result, we supported seven out of 358 of these proposals.

Expanding stewardship choice

BlackRock Voting Choice

Launched in January 2022, BlackRock Voting Choice — sometimes known as pass-through voting — provides eligible clients with more opportunities to participate in the proxy voting process, where legally and operationally viable. Since then, BlackRock has continued to expand Voting Choice by extending the pool of eligible client assets that can participate and expanding the range of voting policies from which clients can choose.

For eligible global institutional clients, in July 2024 we added Egan-Jones as the third voting policy provider on our BlackRock Voting Choice platform. With the addition of Egan-Jones’ voting guidelines, eligible institutional clients have access to 16 distinct voting guidelines from three voting policy providers, in addition to BIS’ Benchmark Policies. Additionally, institutional clients with separately managed accounts (SMA) may implement custom voting guidelines reflecting their investment goals and preferences. In 2025, we expanded BlackRock Voting Choice to eligible clients in select Swiss-domiciled funds, adding to existing availability in funds in the U.S., Canada, Ireland, and the UK.

For eligible U.S. retail shareholders, in February 2024, we launched a pilot program to make BlackRock Voting Choice available for our largest ETF for the first time. In early 2025, we formalized this innovative program and announced the inclusion of the Egan-Jones’s Wealth-Focused Policy as a third-party voting policy provider, expanding the available proxy voting policy options to eligible shareholders in the U.S. from seven to eight.

As of June 30, 2025, $3.3 trillion of BlackRock’s $6.9 trillion total index equity AUM are eligible to participate in BlackRock Voting Choice, where legally and operationally viable, with clients representing ~$784 billion in index equity AUM exercising this option.

Stewardship for funds with explicit climate and decarbonization objectives

Some of our clients are pursuing decarbonization as an investment objective, including many of our largest European clients, who have made net zero commitments. To support our clients’ unique and varied investment objectives, BlackRock offers a wide range of investment products and strategies that our clients may choose from, including those with explicit decarbonization or climate-related investment objectives.

In July 2024, we launched the Climate and Decarbonization Stewardship program, and the applicable proxy voting Guidelines. The Guidelines only apply to those funds that BlackRock offers to clients that have climate and decarbonization investment objectives where the funds’ respective governing body has explicitly approved the application of the Guidelines. SMA clients have several stewardship options, including instructing BlackRock to apply the Guidelines to their SMA holdings.

As of June 30, 2025, total funds and SMAs that have chosen to apply the Guidelines represent $158 billion of client index equity AUM, or approximately 2% of our clients’ total public equity AUM.

Parting thoughts

This report demonstrates how we undertake our stewardship activities under our Benchmark Policies on behalf of clients who have entrusted us with this important responsibility.

We did this through listening to, learning from, and engaging with, companies to understand how they are managing material business risks and opportunities.

Where our clients entrusted us to vote on their behalf as their fiduciary, we did so through independent, detailed analysis to inform our voting decisions.

In the 2025-26 proxy year, we look forward to continuing to do so to advance our clients’ long-term financial interests. We also remain committed to providing clients with a range of investment product choices to support their individual investment goals and preferences.

Link to the full report can be found here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.